Transform. Connect. Tokenize.

Build Blockchain

Certificate Voting Membership Marketplace

Swiftly

Unlock the potential of web3 with our seamless solution for creating cutting-edge blockchain-based business applications, making development effortless and value realization swift

Education

Real Estate

Healthcare

Supply Chain

Startup

COMPREHENSIVE API PLATFORM IN BLOCKCHAIN

Blockchain solution you need. One API.

Tokenization refers to the process of representing the value and ownership of physical or financial assets using digital tokens on a blockchain.

TokenFirst opens the gateway to a world where creating digital assets, smart contracts, and blockchain networks is not just a possibility, but a seamless reality. With TokenFirst, you can bring your blockchain vision to life in a fraction of the time and at a fraction of the cost, revolutionizing the way you do business.

Unlock the Benefits of TokenFirst

Cost Savings

Start move to blockchain without Breaking the Bank.

Seamless User Experience

We fully manage protocol complexities and you can experience transitioning to blockchain.

Comprehensive Features

TokenFirst APIs powered blockchain applications for end users worldwide.

Fast Development

Quickly turn solidity smart contracts into APIs that any developer can understand.

Insightful Exploration

Blockchain Case Study

Our BaaS ecosystem is designed for synergy. Each user is equipped with a unique digital wallet identity, enabling them to securely hold and manage their tokens—be it certificates, memberships, or digital assets.

This interconnected environment ensures a fluid and flexible experience, offering endless possibilities for utilization and growth.

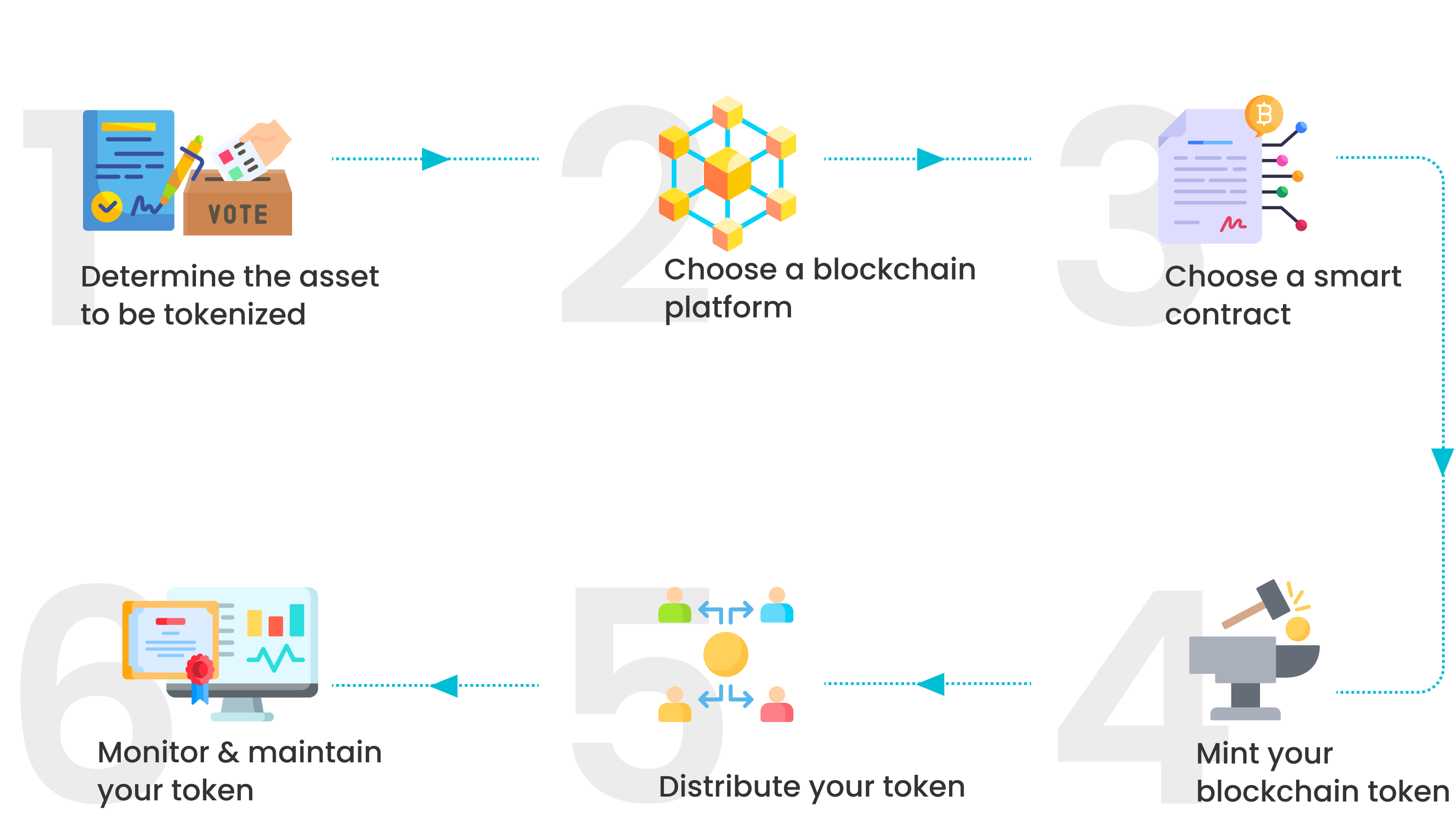

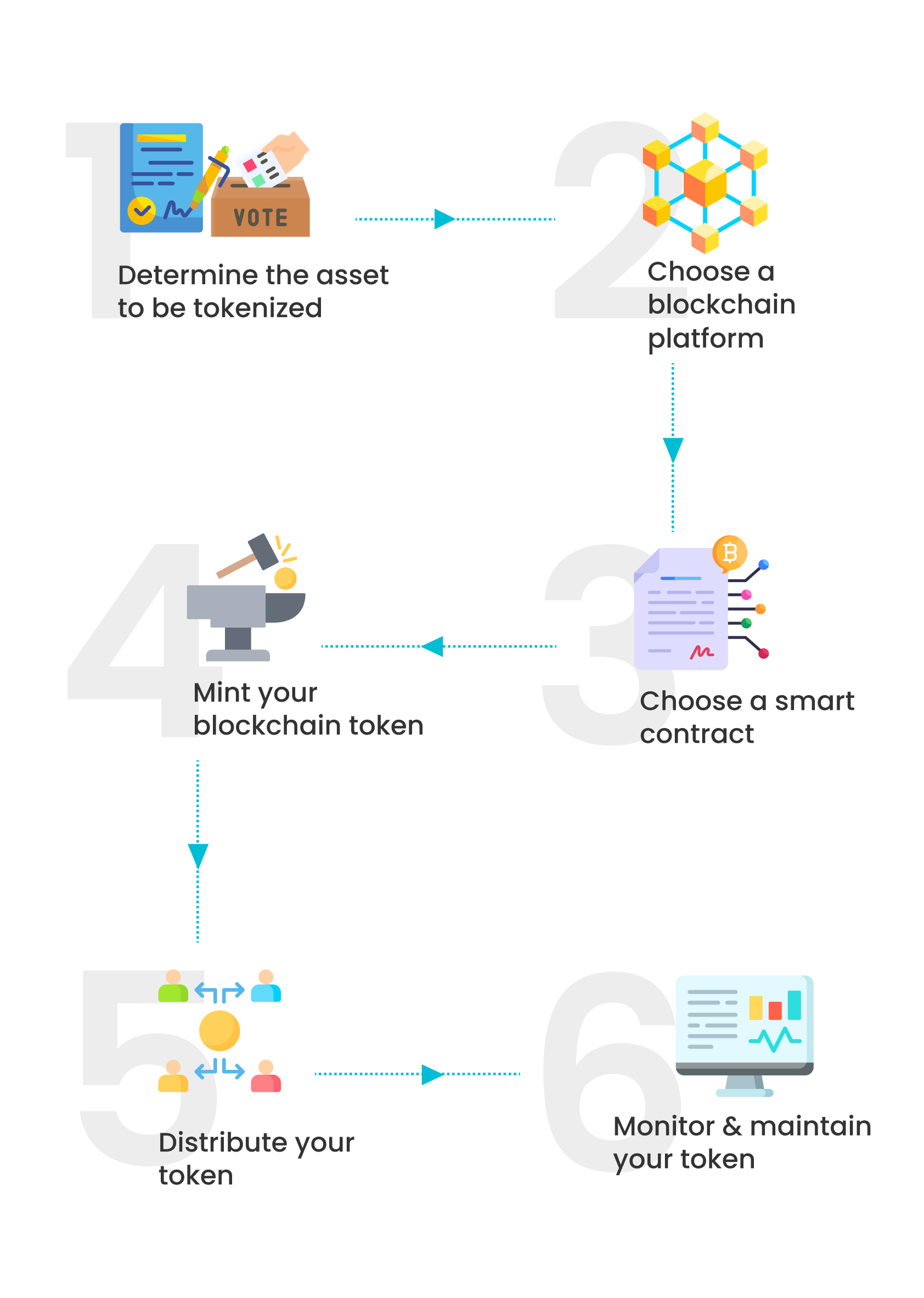

TOKENIZATION FLOW

How it works

Why you need Blockchain solution ?

One compelling use case for certificate tokenization involves the buying and selling of academic credentials.

With traditional paper-based certificates, verifying the authenticity of academic qualifications can be cumbersome and time-consuming.

FAQ

What is tokenization?

Tokenization is the process of converting ownership rights to physical assets, also known as real assets, into digital tokens on a blockchain. Real assets can include a wide range of tangible assets such as real estate properties, precious metals, artwork, commodities, or even natural resources like oil and gas reserves.

Tokenizing real assets involves representing ownership stakes or rights to these physical assets as digital tokens on a blockchain network. Each token corresponds to a specific fraction or unit of the underlying real asset. These tokens are recorded on a blockchain, providing an immutable and transparent ledger of ownership and transfer.

What are the primary benefits of tokenizing real-world assets?

Tokenizing real-world assets offers increased liquidity, fractional ownership opportunities, enhanced transparency, accessibility to a global investor base, and streamlined asset management processes.

What regulatory considerations need to be addressed when tokenizing real-world assets?

When tokenizing real-world assets, regulatory considerations include compliance with securities laws, anti-money laundering (AML) and know-your-customer (KYC) regulations, taxation laws, jurisdictional requirements, consumer protection laws, data protection regulations, and smart contract audits.

What are the key challenges associated with tokenizing real-world assets?

The key challenges associated with tokenizing real-world assets include regulatory compliance, legal complexities, lack of standardized frameworks, valuation issues, liquidity concerns, interoperability challenges, cybersecurity risks, and investor education and adoption hurdles.

How does tokenization impact the ownership and transferability of assets?

Tokenization impacts the ownership and transferability of assets by digitizing ownership rights and facilitating seamless transferability through blockchain technology.

Each asset is represented by digital tokens recorded on a blockchain, providing a transparent and immutable ledger of ownership. This enables fractional ownership, enhances liquidity, reduces transaction costs, eliminates intermediaries, and streamlines the transfer process, making asset ownership more accessible, transparent, and efficient.

What role do smart contracts play in real-world asset tokenization?

Smart contracts play a crucial role in real-world asset tokenization by automating and enforcing the terms of agreements related to tokenized assets. These self-executing contracts are programmed with predefined rules and conditions governing asset ownership, transfer, and management. Smart contracts facilitate the issuance, transfer, and redemption of digital tokens representing ownership stakes in real-world assets, without the need for intermediaries.

They enable secure and transparent transactions, automate compliance and regulatory requirements, ensure the integrity of asset ownership records, and reduce administrative overhead.

Build Blockchain Magic with TokenFirst

Ready to explore further? Connect with us today to embark on your journey.